Market Data and ECN Connectivity

We provide the framework for plug and play integration with multiple ECN’s, reducing integration cost and increasing operational efficiency. We build dashboards to configure and monitor ECN activities and exception handling. We perform integration, data processing and storage solutions with market data sources and liquidity providers. Additional expertise includes processing of financial messages, exchange protocols, and data formats.

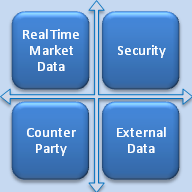

Market and Reference Data

We have strong experience with reference data integration, reconciling external data references, inbound data feeds, counterparty data and real-time market data. We provide efficient and innovative solutions for reference data connectivity, processing, and storage needs.

Data Sources

|

Protocols and API

|

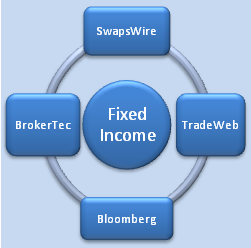

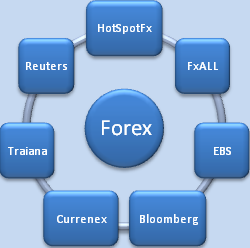

ECN Connectivity

| We have integration experience with major liquidity provider for Foreign Exchange, Fixed Income,Credit Derivatives and Interest Rate Products. |

|